Keeping your plan funding in check

Learn how valuations help keep your pension benefit secure—now and into the future

Your pension plan is designed to give you financial stability in your retirement. With the ever-changing shifts in your career, personal life and the economy, your plan helps you embrace the future with assurance and security. One way the plan can do this is through regular valuations.

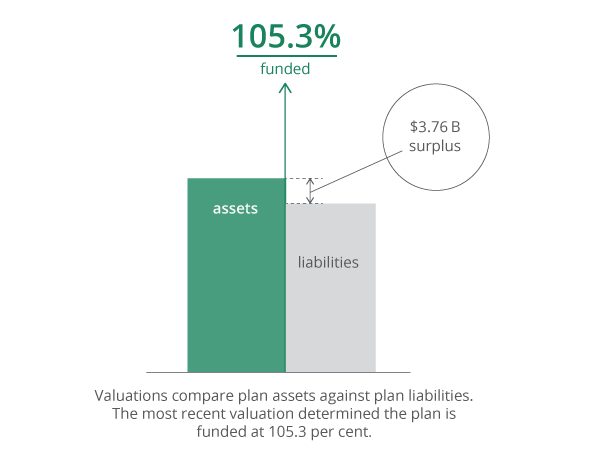

Recent results

The most recent valuation was conducted as at December 31, 2021. It determined the plan is funded at 105.3 per cent. The surplus is a result of the plan’s strong investment performance and good governance.

Of the $3.76 billion surplus, about $2.47 billion will be kept in the basic account as a contribution cushion. Another $277 million will be used to maintain the current contribution rates. The remaining $1.02 billion will be divided between the inflation adjustment and rate stabilization accounts.

The rate stabilization account helps protect working members and employers from contribution rate fluctuations in the future.

With the strong valuation result, active members’ contribution rate remains unchanged. The cost-of-living adjustment (COLA) cap is removed for the next three years, 2023 through 2025.

How valuations work

Valuations measure money coming into and going out of the plan. In other words, they look at plan assets and plan liabilities. Assets include plan funds and the current value of future contributions. Assets are compared against liabilities, which represent the money that needs to be paid out as pension benefits in the future.

There are two questions a valuation seeks to answer:

- What is the best estimate of future costs?

- What adjustments are needed today to pay future pensions?

Valuations also consider the funding of the inflation adjustment account (IAA), which funds cost-of-living adjustments to pension payments. The funding level of this account determines the sustainable COLA cap for the next three years. Having a cap helps maintain the long-term sustainability of funds in the plan’s IAA for current and future retired members.

Valuations are based on assumptions

Valuations look at two sets of assumptions, which the Municipal Pension Board of Trustees (board) sets ahead of time:

- Economic assumptions, such as investment returns, inflation and salary increases

- Demographic assumptions, such as retirement age, life expectancy and disability rates

The investment return is probably the most significant of the economic assumptions. It has the greatest effect on the value of the pension fund. If assumptions about investment returns are too low, contributions may be higher than what is required to fund the plan. On the other hand, if the assumptions are too high, contributions may be lower than what is required to fund the plan. Whether the plan funding results in a surplus or deficit, the board has options outlined under the plan’s joint trust agreement on how to address the plan’s financial position. Ultimately, the board seeks to select investment return assumptions that lead to stable contributions.

Demographic assumptions are based on membership data. They are formed by asking questions like, What age do members retire? What are the statistics telling us about life expectancy? How many members have gone on disability? The board considers the plan’s experience and demographic trends as part of their assumptions.

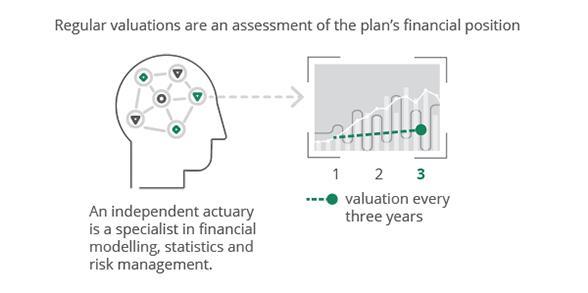

How often valuations are done

Every three years, as required by legislation, an independent actuary (a specialist in financial modelling, statistics and risk management) assesses the financial position of the plan. The actuary uses tools and modelling techniques to forecast the plan’s financial position. The next valuation will assess the state of the plan as at December 31, 2024.

Valuations provide the board with a full picture of the plan’s funded status and the factors that positively or negatively affect the plan’s finances. With this information, the board is better able to make decisions and take actions to keep the plan sustainable. The valuation is an important tool for the board to meet its goal to secure a pension for all members.

COVID-19 update

The COVID-19 pandemic has adversely affected financial markets around the world. While there was no way to anticipate the pandemic, the Municipal Pension Board of Trustees (board) has been anticipating for some time a correction in the decade-long market growth. The board has been working with British Columbia Investment Management Corporation, the plan’s investment agent, to adjust the portfolio holdings to reduce risk.

Plan investments are broadly diversified, which cushions the overall portfolio against lower returns in any one asset category. Because your pension is paid from a large pool of assets, the plan is able to meet its commitments to members now and in the future.